The Veterans Affairs Servicing Purchase (VASP) loan is a specialized program created by the Department of Veterans Affairs (VA) to assist veterans and active-duty service members who are at risk of losing their homes due to financial difficulties. When traditional solutions such as repayment plans or loan modifications fail, the VASP program steps in to help by allowing the VA to purchase delinquent loans from servicers. This critical intervention provides homeowners with a last-resort option to prevent foreclosure and potentially retain their homes.

Why It’s Relevant for Veterans and Active-Duty Service Members Facing Foreclosure g

For veterans and active-duty service members, owning a home is often a source of stability and pride, but financial struggles—whether due to unexpected life events, health issues, or deployment-related hardships—can put that stability at risk. The VASP loan is specifically tailored for VA-guaranteed loan holders who are on the brink of foreclosure and have no other viable alternatives. Through this program, the VA aims to provide a safety net for these individuals, helping them navigate their financial challenges while still maintaining ownership of their homes.

Importance of Understanding This Option as a Last Resort for Protecting Your Home

Veterans and service members must understand that the VASP loan is not a first-line solution but rather a last-resort measure. Before pursuing this option, borrowers will have explored other avenues, such as repayment plans or loan modifications, with their loan servicer. If these efforts do not succeed, VASP becomes a lifeline, giving homeowners one final opportunity to avoid foreclosure. Understanding how and when to access this program can make the difference between losing a home and securing a second chance to keep it.

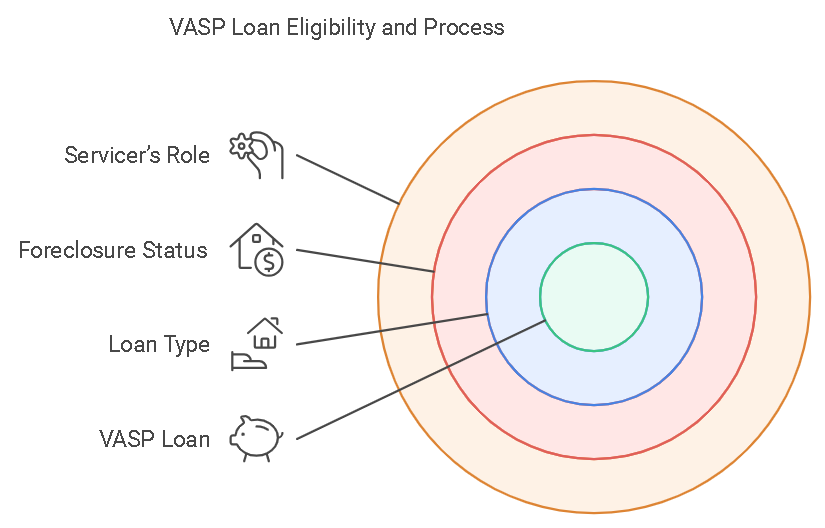

Eligibility Criteria

To qualify for a Veterans Affairs Servicing Purchase (VASP) loan, borrowers must meet specific conditions related to their loan type, foreclosure status, and involvement of their loan servicer. The program is designed to provide assistance only when other options have been fully explored.

Who Qualifies for the VASP Loan?

The VASP loan is exclusively available to veterans and active-duty service members who have VA-guaranteed home loans. It is specifically designed for those who are at serious risk of foreclosure, offering them a last-resort option after other potential solutions, such as repayment plans or loan modifications, have been exhausted.

Loan Type

Only VA-guaranteed home loans are eligible for the VASP program. This means that if your mortgage is backed by the VA, and you’re struggling to keep up with payments, you may qualify for this assistance. The VA guarantee ensures that the loan has been underwritten according to specific guidelines, and the VASP program works within these parameters to provide foreclosure relief. Borrowers with conventional, FHA, or other non-VA loans are not eligible for the VASP loan.

Foreclosure Status

To qualify for VASP, the borrower must be actively facing foreclosure. This means they are significantly behind on their mortgage payments, and foreclosure proceedings are either imminent or already underway. The VASP program is not an option for borrowers in the early stages of payment difficulties—it is intended for those who are close to losing their homes and have exhausted all other methods of avoiding foreclosure, such as loan modifications or forbearance agreements.

Servicer’s Role

An important aspect of the VASP program is that veterans cannot apply directly. Instead, their loan servicer plays a crucial role in determining eligibility. The loan servicer is responsible for assessing the borrower’s financial situation, exploring all possible alternatives to foreclosure, and ultimately deciding whether VASP is the best solution. If the servicer determines that no other options will work, they will then submit the necessary information to the VA for approval. This evaluation process underscores the importance of working closely with your loan servicer throughout your financial struggles, as they are the ones who can initiate the VASP process on your behalf.

Steps to Access VASP

Navigating the Veterans Affairs Servicing Purchase (VASP) loan process can seem overwhelming, but by following these steps, veterans and active-duty service members facing foreclosure can make the process smoother and increase their chances of success.

1. Contact Your Loan Servicer

The first and most crucial step in pursuing a VASP loan is to contact your loan servicer as soon as you realize you’re struggling with mortgage payments. Reaching out early gives you and your servicer time to explore all possible solutions, rather than waiting until foreclosure is imminent. Proactively communicating with your servicer also signals to them that you are committed to finding a solution, which can help in building a cooperative relationship.

The servicer will review your financial situation, explain the different options available, and work with you to determine the best path forward. Since you cannot apply for the VASP loan on your own, establishing this communication with your servicer early on is vital to the process.

2. Explore Alternatives First

Before considering the VASP loan, your servicer is required to explore other alternatives to foreclosure. These options are often more straightforward and may help you avoid losing your home without the need for a VASP loan. Common alternatives include:

- Repayment Plans: Your servicer may offer a repayment plan that allows you to catch up on missed payments over time.

- Special Forbearances: This option temporarily reduces or suspends your mortgage payments, giving you time to improve your financial situation.

- Loan Modifications: The terms of your loan may be adjusted to make your payments more affordable, either through a lower interest rate, extended loan term, or other modifications.

The servicer will review these alternatives first and only proceed to the VASP loan if none of these options are viable for your situation.

3. VASP Submission by the Servicer

If all other foreclosure avoidance options have been exhausted and the servicer deems that a VASP loan is the best or only solution, they will initiate the submission process to the VA. This submission includes detailed information about your financial status, loan history, and the efforts made to avoid foreclosure.

The servicer’s role is essential here because they are the ones authorized to submit your case for VASP consideration. Keep in mind that the VA will not accept submissions directly from borrowers—only through their services. This highlights the importance of maintaining a strong line of communication with your loan servicer throughout the process.

4. Implementation Timeline

The VASP program has specific implementation dates that borrowers and servicers need to be aware of:

- May 31, 2024: Starting on this date, the VASP program will begin accepting submissions from loan servicers. If you are eligible and your servicer determines that VASP is the right solution for you, they can start the submission process at this time.

- October 1, 2024: By this date, the VASP program is expected to be fully operational. This means that all the necessary infrastructure and processes should be in place to support a full rollout of the program, ensuring that eligible veterans can benefit from the program efficiently.

These dates are important to keep in mind if you are nearing foreclosure and seeking help through the VASP program. Acting before these dates may allow your servicer to explore other solutions, but after these dates, VASP will be fully available if needed.

5. Stay Informed

Once the VASP process is underway, it is critical to stay engaged and informed throughout the entire process. Regularly communicate with your loan servicer to track the status of your application and any updates regarding the VASP submission.

Some tips to stay informed include:

- Set Regular Check-Ins: Schedule regular check-ins with your servicer to stay updated on any developments. Don’t wait for them to reach out to you—be proactive.

- Keep Records: Document all communications with your servicer. This includes phone calls, emails, and any correspondence related to your VASP submission or other foreclosure avoidance efforts.

- Understand Your Timeline: Know the key dates and deadlines in your situation so you can be prepared for what comes next.

By staying informed and involved, you can help ensure that your VASP loan application progresses smoothly and that you are well-prepared to address any issues that arise along the way.

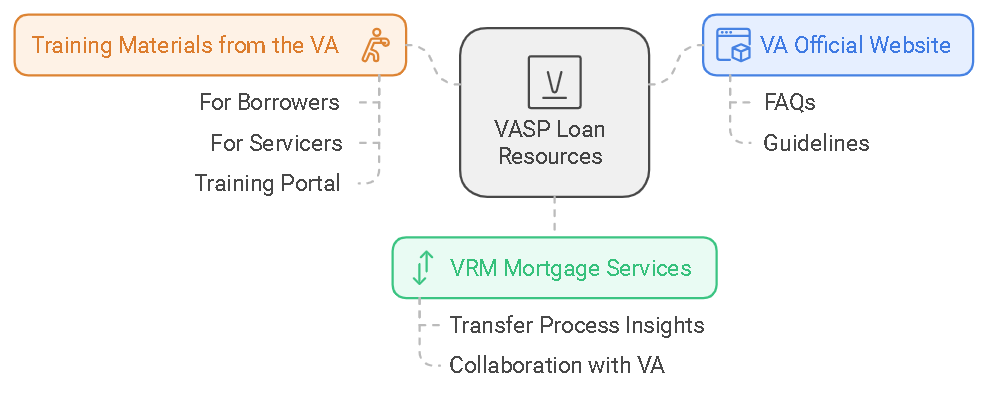

Additional Resources

For veterans and active-duty service members seeking more detailed information on the Veterans Affairs Servicing Purchase (VASP) loan, there are several helpful resources available. These will guide you through the process and provide deeper insight into the program’s workings.

1. VA Official Website

The Department of Veterans Affairs provides comprehensive details on the VASP program, including FAQs and guidelines to help you better understand your eligibility, the process, and the next steps. You can access the official VA VASP FAQ page here.

2. VRM Mortgage Services

For more specific information regarding the VASP Transfer Program, VRM Mortgage Services offers valuable insights. VRM works closely with the VA to manage the transfer process of loans through VASP, making this a critical resource for both servicers and borrowers.

3. Training Materials from the VA

The VA also provides training materials for both borrowers and servicers. These materials are particularly helpful for veterans who want to understand the VASP loan in-depth or need assistance navigating the process. Servicers can also utilize this training to ensure they follow proper guidelines when submitting VASP loan applications. You can access these materials through the VA’s Training Portal.

By using these resources, veterans and service members can become more informed about the VASP program and take control of their financial situation with the proper knowledge and support.

Frequently Asked Questions

1. What is a VASP loan and who qualifies?

A Veterans Affairs Servicing Purchase (VASP) loan is a program that allows the VA to purchase delinquent VA-guaranteed loans from servicers to prevent veterans from losing their homes. To qualify, you must have a VA-guaranteed loan, be facing foreclosure, and have exhausted other options like repayment plans or loan modifications.

2. How does the VA purchase delinquent loans from servicers?

The VA works with loan servicers to evaluate the financial situation of veterans facing foreclosure. If no other options are viable, the servicer submits the borrower’s information to the VA, which may then decide to purchase the delinquent loan under the VASP program.

3. Can a veteran apply directly for a VASP loan?

No, veterans cannot apply directly for a VASP loan. Instead, their loan servicer must assess the situation and submit the necessary information to the VA if they determine that VASP is the best option to avoid foreclosure.

4. What should I do if I’m facing foreclosure on a VA-guaranteed loan?

If you’re facing foreclosure, the first step is to contact your loan servicer immediately. They will evaluate your financial situation and discuss potential alternatives such as repayment plans, special forbearances, or loan modifications. If these options are not feasible, your servicer may submit your case to the VA for consideration under the VASP program.

5. When does the VASP program officially begin?

The VASP program will begin accepting submissions from loan servicers starting on May 31, 2024, with a full rollout expected by October 1, 2024. Staying in touch with your servicer during this period is important to ensure you’re updated on any changes or additional requirements.