Your auto loan interest rate plays a crucial role in determining the total cost of your vehicle purchase. Understanding how to find the best rate can save you a significant amount of money over the life of your loan. Here’s a detailed guide to help you navigate the process:

The Importance of Your Credit Score

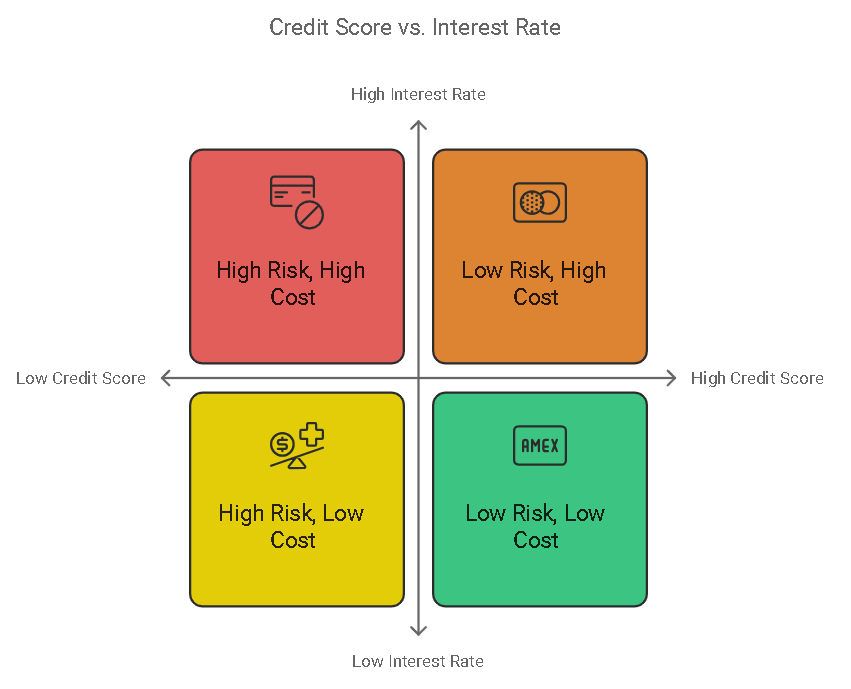

Overview of Credit Score Impact

Your credit score is one of the most significant factors that lenders use to determine your auto loan interest rate. A higher credit score indicates to lenders that you are a lower-risk borrower, which often translates to a lower interest rate. Conversely, a lower credit score suggests higher risk, leading to higher interest rates. For example, borrowers with excellent credit are more likely to secure a better rate, reducing their overall loan cost.

Current Averages by Credit Score

Understanding current average rates can help you gauge where you stand. According to recent data, the average interest rate for a new car loan for individuals with excellent credit (typically a score of 720 or higher) was around 5.38% in 2024. In contrast, those with poor credit scores might face average rates as high as 12.85%[2]. These figures highlight the significant impact your credit score can have on your loan terms.

How to Check Your Credit Score

Before applying for an auto loan, it’s essential to check your credit score. You can obtain a free credit report from major credit bureaus such as Equifax, Experian, and TransUnion once a year. Many financial institutions also offer free credit score checks as part of their services. Monitoring your credit score allows you to address any issues or inaccuracies before applying for a loan.

Obtain Pre-Approval from Multiple Lenders

Why Pre-Approval Matters

Getting pre-approved for an auto loan before you start shopping for a vehicle provides several benefits. It gives you a clear idea of how much you can borrow and the interest rate you can expect based on your credit profile. Pre-approval also strengthens your bargaining position with dealers, as it demonstrates that you are a serious buyer with secured financing.

Types of Lenders

- Traditional Banks: Established banks often offer competitive rates and terms. However, their approval process can be more stringent, and their rates might not always be the lowest.

- Credit Unions: Credit unions frequently offer lower interest rates compared to banks due to their non-profit status and member-focused approach. They are a great option to consider if you are eligible for membership.

- Online Lenders: Online lenders can provide quick pre-approval and competitive rates, often with a streamlined application process. They are worth exploring for convenience and potentially lower rates.

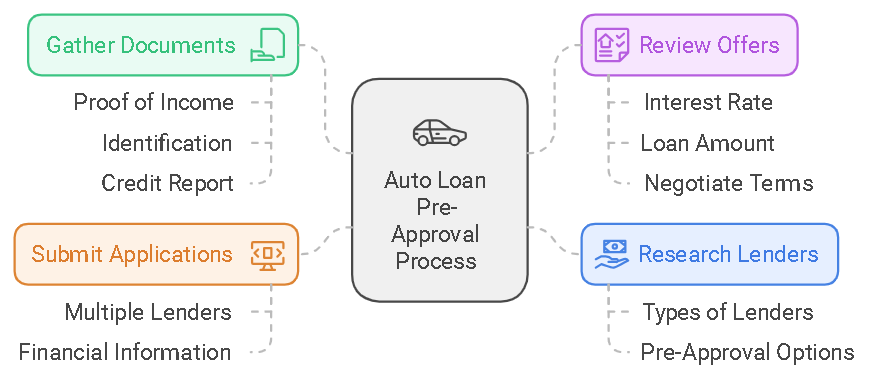

Steps to Get Pre-Approved

- Research and Choose Lenders: Start by researching different types of lenders to find those that offer pre-approval for auto loans.

- Gather Required Documents: Prepare necessary documents such as proof of income, identification, and your credit report.

- Submit Applications: Apply for pre-approval with multiple lenders to compare rates and terms. This typically involves filling out an application form and providing your financial information.

- Review Offers: Once you receive pre-approval offers, review the terms, including the interest rate and loan amount. This will help you understand what you can afford and negotiate better terms with dealers.

Compare Interest Rates from Different Lenders

Once you have obtained pre-approval offers from various lenders, it’s crucial to compare these offers carefully to find the best deal. Here’s how to evaluate and compare interest rates and terms:

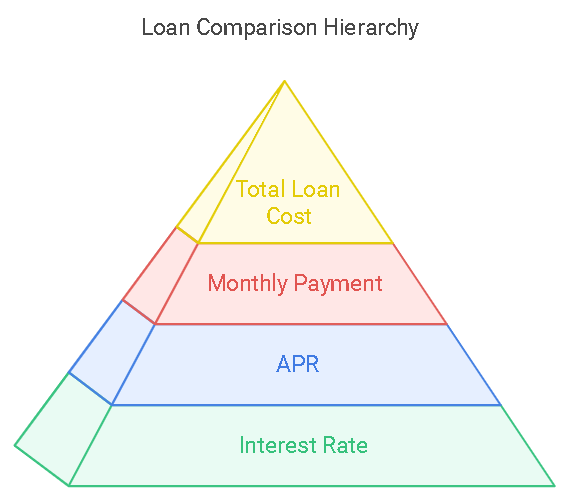

How to Compare Offers

When comparing interest rates from different lenders, start by examining the Annual Percentage Rate (APR), which reflects the total cost of borrowing, including interest and fees. A lower APR generally means a less expensive loan over time. Pay attention to the following elements:

- Interest Rate: The basic rate you’ll be charged for borrowing.

- APR: Includes the interest rate and any additional fees or costs.

- Monthly Payment: Calculate the monthly payment based on the loan amount, interest rate, and term to understand how it fits into your budget.

- Total Loan Cost: Look at the total amount you will pay over the life of the loan, including principal and interest.

Loan Term Impact

The length of your loan term significantly affects your interest rate and total loan cost. Generally, shorter loan terms come with lower interest rates but higher monthly payments. Longer terms might offer lower monthly payments but can result in higher overall interest costs. For example:

- Short-Term Loans: Typically 36 to 48 months. They offer lower interest rates but higher monthly payments.

- Long-Term Loans: Often 60 to 72 months or more. They usually come with higher interest rates and can cost more in total interest, but offer lower monthly payments.

Additional Factors to Consider

In addition to interest rates, consider these factors when comparing loan offers:

- Fees: Look for application fees, origination fees, and any prepayment penalties that could impact the total cost of your loan.

- Penalties: Check for any penalties for early repayment or late payments, as these can affect the overall affordability of the loan.

- Loan Conditions: Understand any conditions or restrictions that come with the loan, such as requirements for auto insurance or conditions for maintaining the loan.

Negotiate with the Dealer

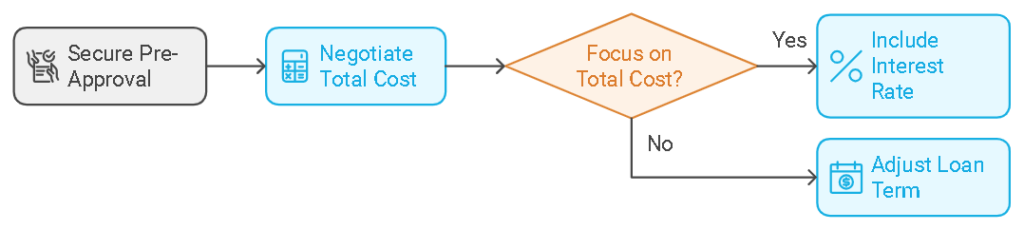

Negotiating with the dealer can potentially secure you a better interest rate and improve the terms of your auto loan. Here’s how to approach this process effectively:

When to Negotiate

Timing is key when negotiating rates at the dealership. Ideally, you should:

- Negotiate After Securing Pre-Approval: With a pre-approval offer in hand, you have a concrete number to use as leverage during negotiations. This shows the dealer that you have other financing options and can help you secure a better rate.

- Negotiate on the Total Cost: Focus on negotiating the total cost of the loan, including the interest rate, rather than just the monthly payment. Dealers may adjust the loan term to meet a monthly payment target, but this can increase the total cost.

Using Pre-Approval as Leverage

Pre-approval offers from banks, credit unions, or online lenders serve as a strong negotiating tool. Here’s how to use it effectively:

- Present Your Pre-Approval: Show the dealer your pre-approval offer to demonstrate that you have a competitive rate and are ready to finalize the loan with another lender.

- Request Better Terms: Ask the dealer if they can match or beat the rate from your pre-approval. Dealers may be willing to offer better terms to secure your business.

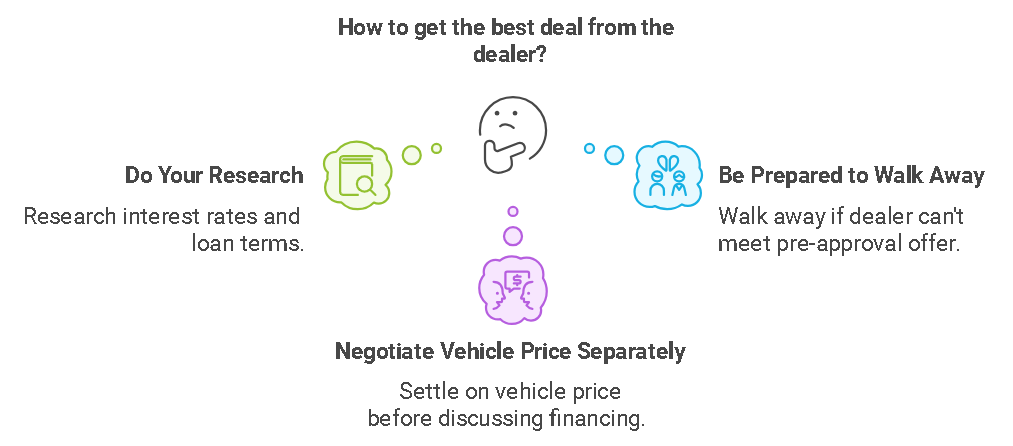

Tips for Effective Negotiation

To get the best deal from the dealer, consider these strategies:

- Do Your Research: Before negotiating, research current interest rates and loan terms to understand what is reasonable.

- Be Prepared to Walk Away: If the dealer cannot meet or beat your pre-approval offer, be prepared to walk away. This puts pressure on the dealer to provide better terms to close the sale.

- Negotiate the Vehicle Price Separately: First, settle on the price of the vehicle before discussing financing. This prevents the dealer from using the loan terms to offset the cost of the car.

Explore Credit Union Options

Credit unions can be a great alternative to traditional banks and dealerships when it comes to auto loans. Here’s why you should consider them and how to take advantage of their offerings:

Benefits of Credit Unions

Credit unions are member-owned, not-for-profit institutions that often offer several advantages over traditional banks and dealerships, including:

- Lower Interest Rates: Credit unions generally offer lower interest rates on auto loans because they operate on a not-for-profit basis, passing savings back to their members.

- Flexible Terms: They may offer more flexible loan terms and conditions, tailored to individual member needs.

- Personalized Service: Credit unions tend to provide more personalized customer service and are often more willing to work with members who have less-than-perfect credit.

Examples of Credit Union Rates

Here are examples of current auto loan rates from different credit unions:

- Resource One Credit Union: Offers auto loan rates starting as low as 5.99% APR for qualified borrowers[1].

- Centris Federal Credit Union: Provides rates as low as 7.49% APR depending on creditworthiness and loan terms[7].

- Navy Federal Credit Union: Rates can be as low as 5.49% APR for new vehicles, reflecting their competitive loan products.

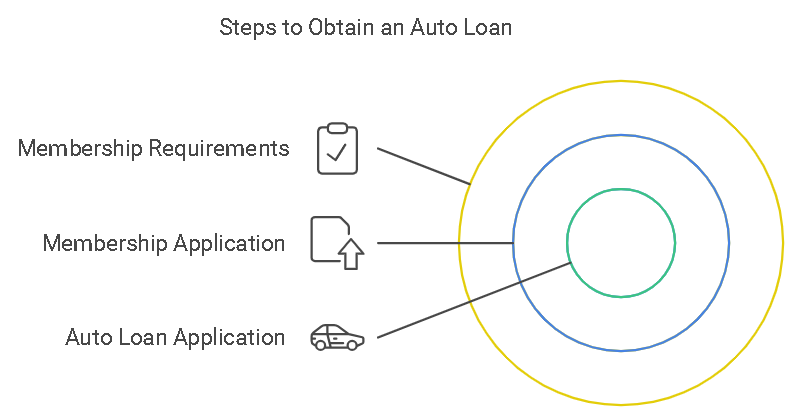

How to Join and Apply

To take advantage of credit union rates, follow these steps:

- Become a Member: Start by meeting the membership requirements, which may include living in a specific area, working for a particular employer, or being part of a certain organization. Membership often requires a small fee or minimum deposit.

- Apply for Membership: Complete the membership application process, which typically involves providing personal information and proof of eligibility.

- Apply for an Auto Loan: Once you’re a member, you can apply for an auto loan. The application process generally includes submitting financial information, proof of income, and details about the vehicle you wish to purchase.

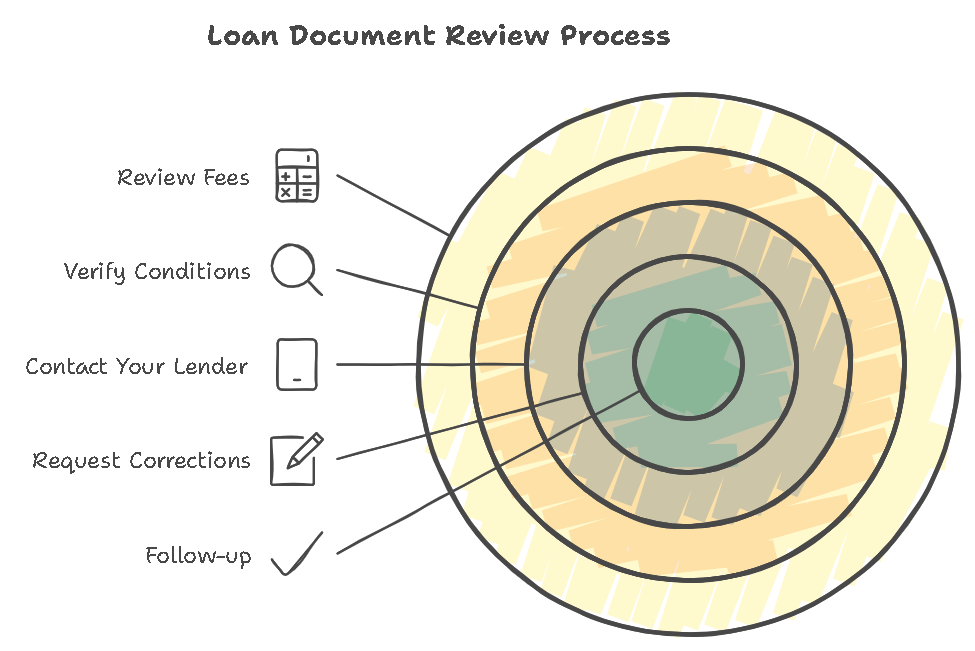

Review Your Loan Documents Carefully

After securing your auto loan, it’s crucial to review your loan documents to ensure everything is accurate and as expected:

Importance of Accurate Documentation

Accurate documentation is essential to avoid any surprises and to ensure you fully understand the terms of your loan. Errors or discrepancies can lead to unexpected costs or complications.

What to Check in Your Documents

When reviewing your loan documents, verify the following key details:

- Interest Rate: Confirm that the interest rate matches what was quoted to you during the application process.

- Loan Term: Ensure the loan term (length of the loan) is correct and as agreed upon.

- Monthly Payment: Check that the monthly payment amount is accurate based on the agreed-upon rate and term.

- Fees: Review any additional fees, such as application fees, origination fees, or prepayment penalties.

- Conditions: Verify any conditions related to the loan, such as requirements for maintaining insurance or restrictions on early repayment.

Addressing Discrepancies

If you find any discrepancies or errors in your loan documents, take the following steps:

- Contact Your Lender: Reach out to your lender immediately to discuss the issue. Provide any necessary documentation or evidence to support your claim.

- Request Corrections: Ask for a revised loan agreement that accurately reflects the agreed-upon terms.

- Follow-up: Ensure that any corrections are made promptly and that you receive updated documents for your records.

Final Tips for Borrowers

Stay Informed

Continuously educate yourself about the auto loan process and market trends to make informed decisions.

Budget Wisely

Consider your budget and financial situation when choosing a loan amount and term. Aim for a loan that fits comfortably within your monthly budget.

Read the Fine Print

Always read and understand the terms and conditions of your loan agreement before signing.

Final Thoughts

Recap of Key Points

Finding and securing the best auto loan interest rate involves several important steps:

Understand Your Credit Score: Your credit score plays a crucial role in determining your interest rate. Ensure you know your score and how it affects your loan options.

Obtain Pre-Approval: Get pre-approved from multiple lenders to compare rates and terms before visiting a dealership.

Compare Offers: Carefully evaluate interest rates, loan terms, and additional fees from different lenders to find the best deal.

Negotiate with the Dealer: Use pre-approval offers as leverage to negotiate a better rate if you decide to finance through the dealer.

Explore Credit Union Options: Consider credit unions for potentially lower rates and favorable loan terms.

Review Loan Documents: Verify all details in your loan documents to ensure accuracy and address any discrepancies.

1 thought on “How to Find Your Auto Loan Interest Rate”