In legal disputes, the concept of conversion plays a pivotal role in addressing issues where one party wrongfully interferes with another’s property. Conversion, in essence, is the act of taking control of someone else’s property in a manner that contradicts their ownership rights. While traditionally associated with physical items, conversion can also extend to more abstract forms of property, such as money.

This blog delves into the question: Can money be subject to conversion under New Jersey law? Understanding this requires a closer look at how the state defines and applies conversion. By examining the principles of conversion and its application to monetary disputes, we can better grasp the nuances of this legal concept.

Definition of Conversion in New Jersey

What is Conversion?

Conversion is a legal term that denotes the unauthorized act of dominion over someone else’s property. Essentially, it’s when an individual exercises control over another’s property in a way inconsistent with the original owner’s rights. In New Jersey, this principle encompasses not just tangible items like goods or real estate, but also extends to intangible forms of property, including money, under specific circumstances.

The core of conversion lies in its capacity to address situations where the rightful owner’s control over their property is usurped. Whether it’s a physical object or a sum of money, if someone wrongfully exerts control or interferes with the property, they may be liable for conversion.

Elements of Conversion

Ownership

To establish a claim for conversion, the plaintiff must first demonstrate that they have rightful ownership of the property in question. This includes proving that they had the legal right to possess the property at the time of the alleged conversion. For money, this means showing that the plaintiff owned the specific funds and had a legitimate claim to them.

Wrongful Interference

The second key element involves proving that the defendant wrongfully interfered with the plaintiff’s right to possess the property. In the context of conversion, this interference can occur through unauthorized control or possession of the property. For money, this could mean using or taking the funds in a manner that contradicts the owner’s intentions or rights, such as misappropriating funds entrusted for a particular purpose.

Application of Conversion to Money

When Does Conversion Apply to Money?

In New Jersey, conversion can indeed apply to money, but there are specific criteria that must be met for a claim to be valid. Conversion involving money generally requires that the funds in question are identifiable and that the defendant’s actions constitute wrongful interference with the plaintiff’s rights.

Identifiability of Money

For money to be subject to conversion, it must be identifiable. This means that the specific funds in question should be distinguishable from other money and directly traceable to the plaintiff. Identifiability is crucial because it ensures that the plaintiff can prove that the exact amount of money was theirs and that it was wrongfully taken or retained by the defendant. This is distinct from a general debt, where the money is not individually identifiable but merely represented by an obligation.

Examples of Wrongful Interference with Money

Misappropriation of Funds

If a person transfers money to another party for a designated purpose, such as for investment or payment, and the recipient uses the funds for their benefit instead, this could be considered wrongful interference. For instance, if a client provides funds to an attorney for handling a legal matter and the attorney uses those funds for personal expenses, this would constitute conversion.

Unauthorized Transfers

In situations where an individual has control over another’s funds without authorization, such as unauthorized withdrawals or transfers from a bank account, it may also be classified as conversion. This interference occurs when the defendant exercises control over the funds in a manner inconsistent with the owner’s rights.

Identifiability Requirement

The identifiability of funds is a key factor in conversion claims involving money. Courts require that the specific amount of money be identifiable and not simply a part of a general debt. For example, if a person claims conversion of funds from a large account but cannot pinpoint the exact amount or the specific transactions involved, the claim may not meet the necessary legal standards. The ability to trace the exact funds in question provides clarity and supports the claim of conversion.

Cases in New Jersey

Marsellis-Warner Corp. v. Rabens

In this case, the court addressed the application of conversion to both physical property and money. The ruling reinforced that conversion can extend to monetary claims if the plaintiff can demonstrate clear ownership and wrongful interference. The case highlighted that the principles governing property conversion also apply to monetary disputes, provided the funds are identifiable.

Case of Misappropriated Funds

This case involved a real estate investor who alleged conversion after discovering that funds meant for property transactions were misappropriated by a fraudster and an attorney. The court acknowledged that while conversion traditionally applied to physical items, it could also apply to money when ownership and wrongful interference were evident. This case further clarified how conversion principles could be adapted to financial disputes.

Practical Implications

Filing a Claim

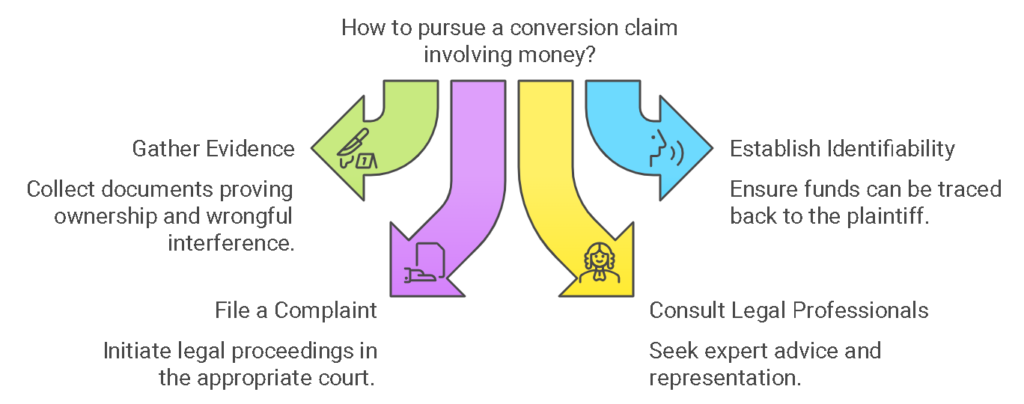

To pursue a conversion claim involving money, the plaintiff should follow these steps:

- Gather Evidence: Collect all relevant documents and evidence that demonstrate ownership of the funds and the wrongful interference by the defendant. This may include transaction records, correspondence, and any other proof of the specific funds involved.

- Establish Identifiability: Ensure that the funds in question can be identified and traced back to the plaintiff. This helps in proving that the exact money was wrongfully controlled by the defendant.

- File a Complaint: Initiate legal proceedings by filing a complaint in the appropriate court. The complaint should outline the basis for the conversion claim, including the specifics of the ownership and wrongful interference.

Consulting Legal Professionals

Navigating a conversion claim, especially one involving money, can be complex. Consulting with a legal professional who specializes in property and financial disputes is essential. A lawyer can provide expert advice on the viability of the claim, assist in gathering and presenting evidence, and represent the plaintiff’s interests throughout the legal process. Their expertise ensures that the claim is properly framed and effectively argued, increasing the likelihood of a favorable outcome.

FAQs Section

1. What is conversion under New Jersey law?

Conversion under New Jersey law refers to the unauthorized exercise of control over someone else’s property, including money. It involves interfering with another person’s right to possess and control their property in a manner inconsistent with their ownership rights.

2. Can money be subject to conversion in New Jersey?

Yes, money can be subject to conversion in New Jersey. For a conversion claim involving money, the funds must be identifiable, and there must be evidence of wrongful interference by the defendant. The key is that the money must be distinct and traceable, rather than part of a general debt.

3. What does it mean for money to be identifiable in a conversion claim?

For money to be identifiable in a conversion claim, it must be distinct and traceable, not just represented by a general debt. Identifiability means that the specific amount of money can be linked to the owner and the wrongful act of interference.

4. What are some examples of wrongful interference with money?

Examples of wrongful interference with money include scenarios where someone misappropriates funds entrusted to them for a specific purpose, such as using money intended for a property purchase for their benefit. Other examples include unauthorized control or possession of funds that belong to someone else.

5. What are some notable cases involving money and conversion in New Jersey?

Notable cases in New Jersey include:

- Marsellis-Warner Corp. v. Rabens established that conversion can apply to both physical property and money.

- A case involving a real estate investor where funds were misappropriated by a fraudster and an attorney, highlighted that conversion principles can apply to monetary disputes when ownership and wrongful interference are demonstrated.

6. What steps should be taken to file a conversion claim involving money?

To file a conversion claim involving money, follow these steps:

- Gather Evidence: Collect documentation and evidence proving the identifiability of the funds and the wrongful interference.

- Consult a Lawyer: Seek legal advice from an attorney who specializes in conversion claims to assess the strength of your case.

- File a Complaint: Initiate legal proceedings by filing a complaint with the appropriate court, outlining your claim and evidence.

7. Why is consulting a legal professional important for a conversion claim?

Consulting a legal professional is crucial because they can provide expert guidance on the complexities of conversion law, help gather and present evidence, and navigate the legal process effectively. An experienced attorney can also advise on the likelihood of success and potential outcomes of the claim.

Final Thoughts

Converting money under New Jersey law is indeed feasible, but it requires careful consideration of several key factors. The ability to prove the identifiability of the funds and establish wrongful interference is crucial for a successful conversion claim. While the concept of conversion traditionally applied to physical property, New Jersey courts have recognized that it can extend to money, provided that the criteria are met.

For individuals considering a conversion claim involving money, it is essential to gather clear evidence and seek professional legal advice. An experienced attorney can provide valuable guidance and help navigate the complexities of such cases. Overall, while challenging, pursuing a conversion claim for money is a viable legal avenue when the facts align with the established legal principles.